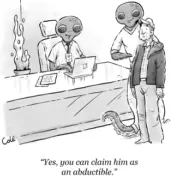

Auditing A Juggalo

INTERNAL REVENUE SERVICE

Robert Evans, Senior Auditor

2001 Butterfield Rd.

Downers Grove, IL 60515

630-983-3269 (office)

630-983-6423 (fax)

TAXPAYER INFORMATION:

Mr. Skanky Pete

P.O. Box 35619

Wauwatosa, WI 53007

Form: 1040

Tax Period(s): 2016

Response Deadline: May 10

NOTICE OF AUDIT AND EXAMINATION SCHEDULED

(THIRD NOTICE)

Dear SKANKY PETE,

Your federal tax return for the period shown above has been selected for examination by the Internal Revenue Service (IRS).

WHAT YOU NEED TO DO:

It is critical that you contact me immediately to schedule an entrance conference, Mr. Pete. Please note that this is the third written notice provided by the IRS. I can be reached between 8:00am-4:30pm, M-F, at the telephone number provided above. I assure you this is not a matter to be taken lightly.

WHAT WE WILL DISCUSS:

During our telephone conversation, we will discuss:

- Prison sentences commonly associated with income tax fraud.

- My sincere hope that your return was filed in jest.

- Why, in 2017, your only contact number appears to be connected to a beeper.

- The disappointment your mother must feel.

- The date, time and location of our entrance conference.

ITEMS FLAGGED FOR EXAMINATION:

During the routine review of your Form 1040, several responses were flagged as irregular or requiring additional explanation. A summary of these items is listed below:

LAST NAME:

Your Form 1040 does not include a last name, only the first and middle names “Skanky Pete.” If this is, in fact, your full legal name, we will require an official birth certificate, along with two forms of photo identification.

DEPENDENTS:

Your return lists six, apparently-adult, dependents about whom we will require additional information before determining the validity of your claimed deductions. These are

Dependent’s Name Dependent’s Relationship to You

Juice Boxxx #1 Juggalette

Baby Nutz Muthafuckin’ Homie4Lyfe

Suckubus Friend with Benefits/Administrative Assistant

King Bong Procurer of the Weed

Milk E. Weigh Eats All My Damn Funyuns!

Joel Osteen Spiritual Advisor

PROFESSION/EMPLOYER:

You have listed your profession as “Juggalo” and your employer as “ICP,” which I am currently unable to identify due to the lack of an associated Employer Indentification Number (EIN). There is an Institute for Cerebral Palsy in Milwaukee, but something tells me that’s probably not it.

We will require a valid W2 from your employer and – in order to correctly categorize your occupation – may request additional clarification as to exactly what it is you juggle.

PROFESSIONAL EXPENSES:

I will need to speak to you in detail about your “home office,” which – according to Google maps – shares an address with what appears to be a topless bar in Menomonee Falls, WI. We also note that you are seeking to deduct $412 in window-tinting on a 1996 Chevy Impala (metallic grape, Illinois license tag: WHOOPx2) as a business expense.

Additionally, we will require documentation related to each of the following expenses:

- Registration fees for “The Gathering of the Juggalos:” Please be prepared to provide evidence of your payment, along with a conference agenda. Might you be able to provide a curriculum vitae for the keynote speaker, Mr. Shaggy 2 Dope?

- Clown White: While I find this deduction highly unorthodox, I must admit that the world of professional juggling is somewhat unfamiliar to me. Please be prepared to explain the professional relevance of this expenditure when we meet.

- 18 cases of Faygo: Certainly you don’t mean the soda?

SOMEONE MAY REPRESENT YOU:

You may have someone represent you during any part of this examination. In your case, Skanky, I highly recommend it. An entire team of professionals actually might not be a bad idea.

Finally, please note that I may be joined by one or more additional auditors, who will serve as observers during our entrance conference. Your Form 1040 has generated a surprising amount of interest amongst my colleagues.

Thank you for your cooperation, Mr. Pete. I look forward to hearing from you. Indeed, I’ve never looked forward to an audit quite so much.

Sincerely,

Robert Evans

Senior Auditor